Article

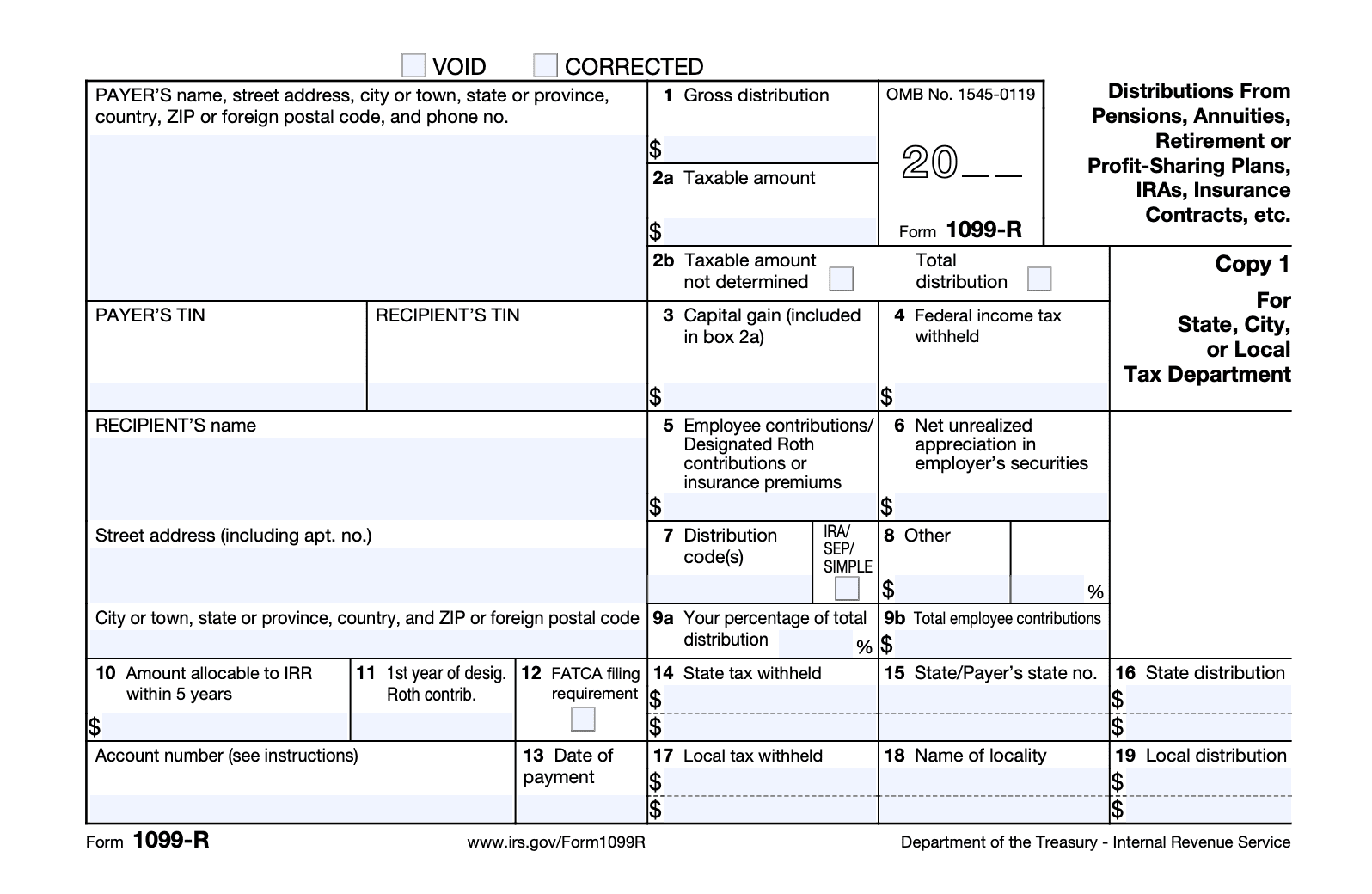

The 1099-R form provides each payee with detailed information of his or her income for the previous year. ERSRI issues 1099-R forms for retirees by January 31st of each year. You should receive your form by mail in the following weeks.

Special note for members who turned age 59.5 during the tax year: You will receive (2) 1099-Rs, each of which will have a different distribution code in Box 7 - Code 2 in Box 7 for the portion of your benefit paid when you were under age 59.5, and Code 7 in Box 7 for the portion of your benefit paid when you were age 59.5 or older.

Additionally, after January 31st your 1099-R is available to view or print by logging into your online retirement account on the ERSRI Member Portal.

If do not receive your form by February 15th, please call the ERSRI Member Service Center at (401) 462-7600 to request a replacement 1099-R.

Click here to learn how to access your 1099-R online.

Here is an easy-to-use guide on how to read your 1099-R:

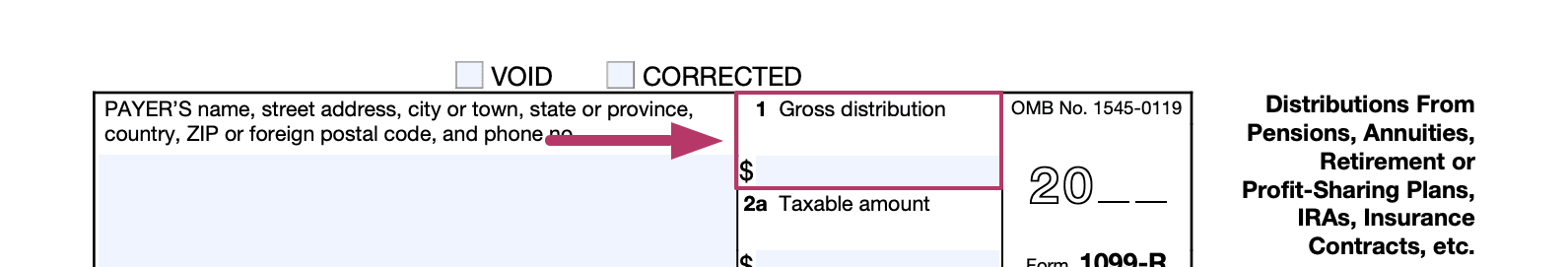

Box 1 - Gross Distribution. This is the sum of all benefits paid to you by ERSRI during the previous calendar year.

Box 2a - Taxable Amount. This box contains the sum of your benefit payments minus your non-taxable monthly exclusion amounts.

Box 2b - This box is not applicable to ERSRI.

Box 3 - This box is not applicable to ERSRI.

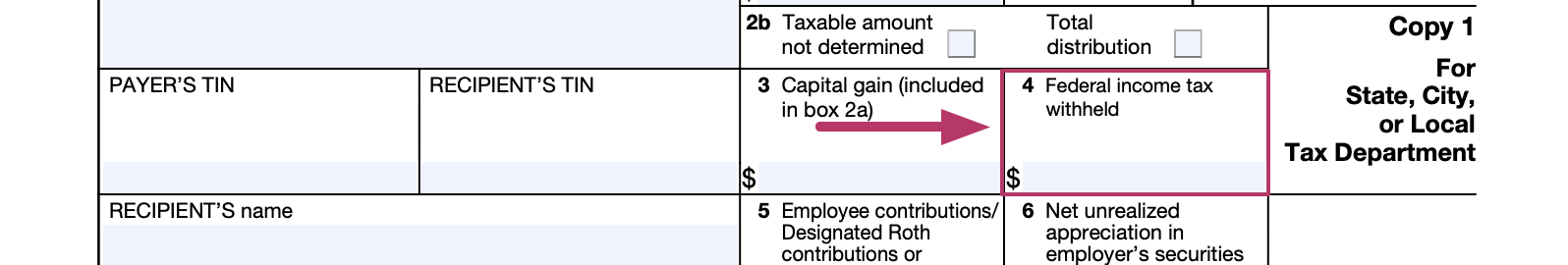

Box 4 - Federal Income Tax Withheld. This box shows any federal income tax withheld from your benefit payments during the year.

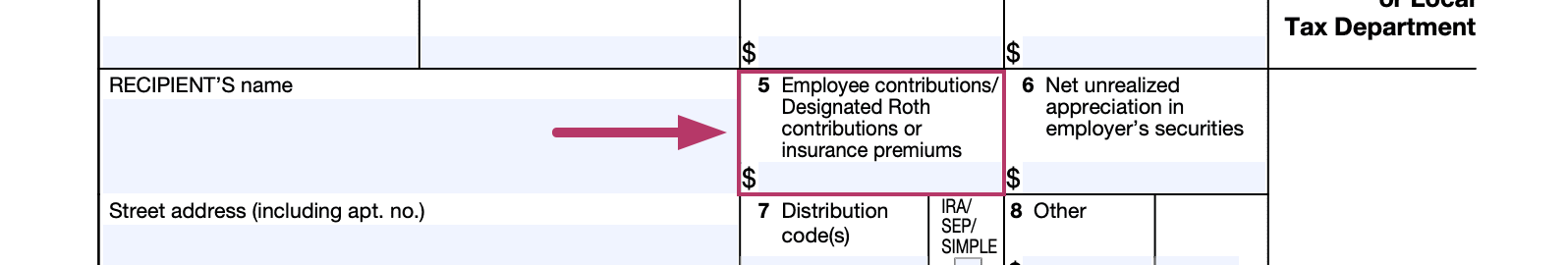

Box 5 - Employee Contributions. This box contains the sum of your non-taxable monthly exclusions for the tax year. The “monthly exclusion amount” or “monthly exclusion” is the part of your benefit on which you have already paid taxes. If you made any after-tax contributions to your ERSRI account — for example, regular contributions you made before 1986 or through a buyback of service time — then you do not have to pay taxes on that part of your benefit. The non-taxable portion of your benefit listed in Box 5 is calculated using the Simplified Method in IRS Publication 575 - Pension and Annuity Income.

Box 6 - This box is not applicable to ERSRI.

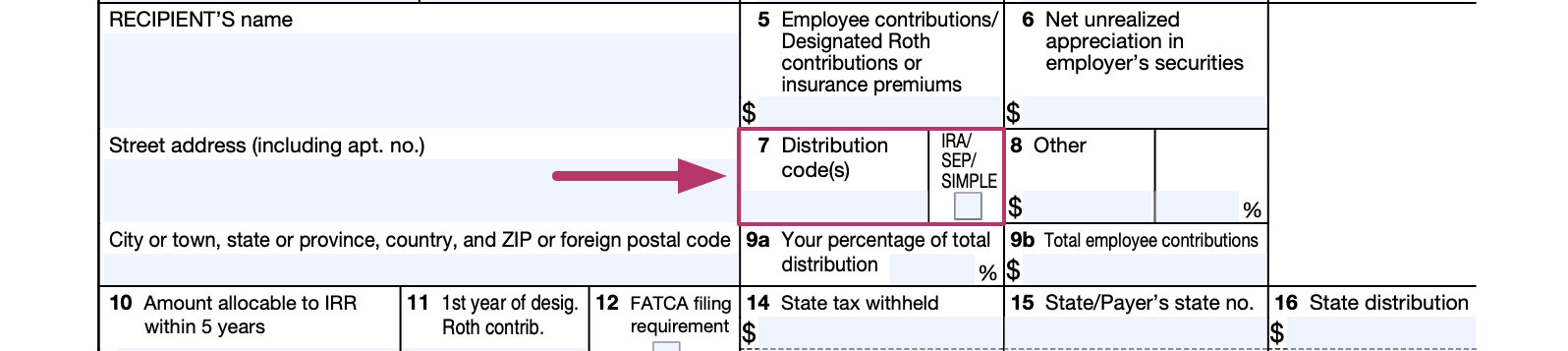

Box 7 - Distribution Code. IRS code identifying the distribution you received. These codes are explained on the back of the 1099-R Form.

Boxes 8, 9a, 9b, 10, 11, 12 and 13 - These boxes are not applicable to ERSRI.

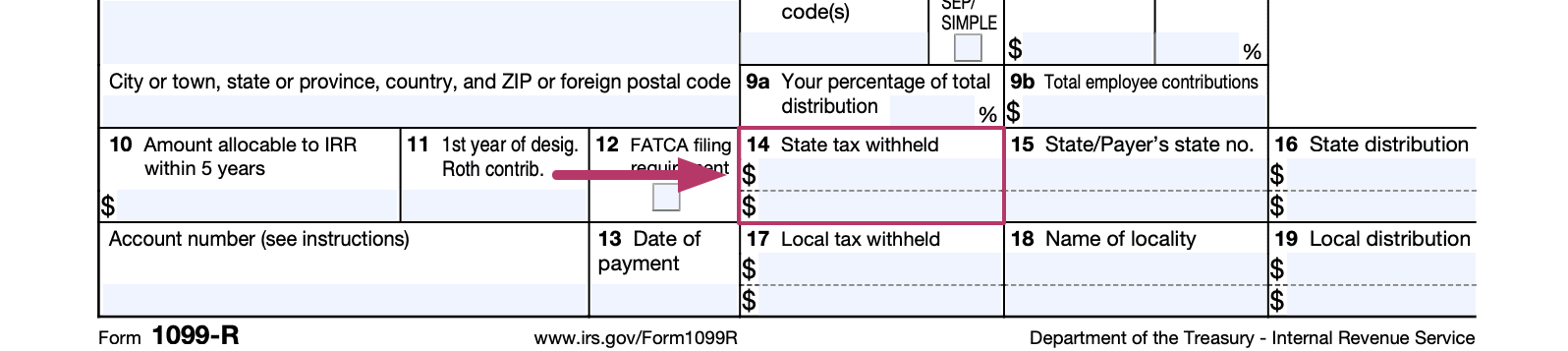

Box 14 - State Income Tax Withheld. Any Rhode Island State income tax deducted from your checks is shown in this box. Note: ERSRI does not withhold state income taxes for any state other than Rhode Island.

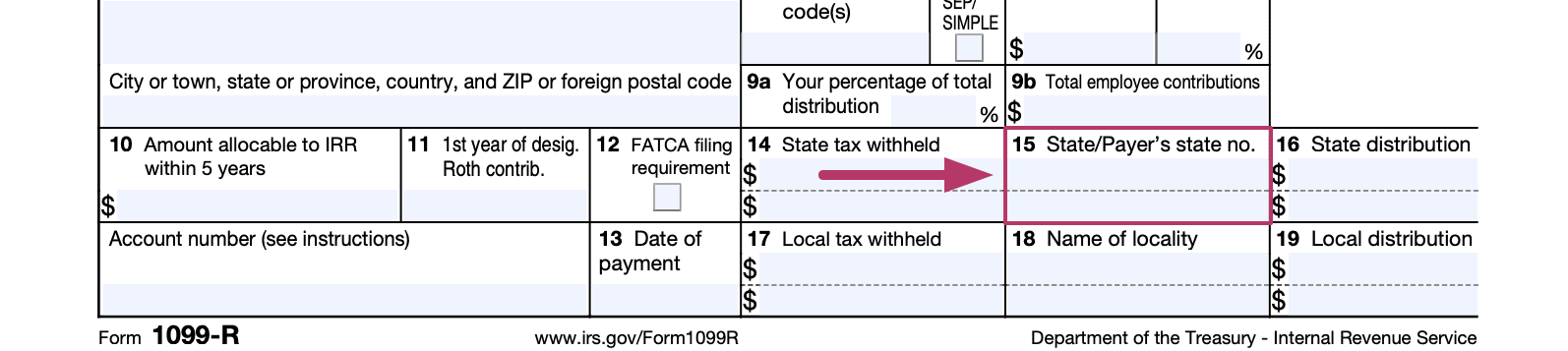

Box 15 – State/Payer’s State No. ERSRI’s state tax ID number.

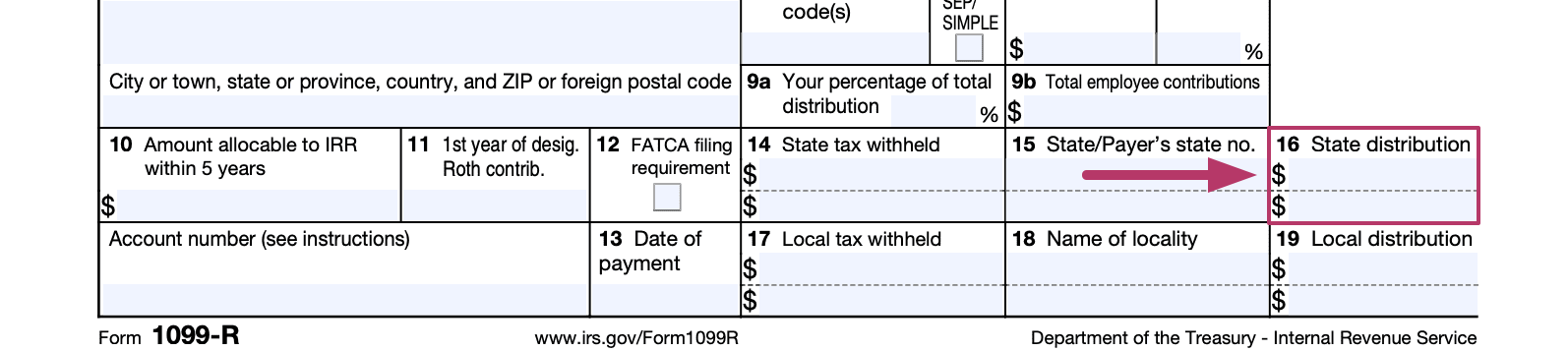

Box 16 – State Distribution. Rhode Island state taxable income.

Boxes 17 through 19 – These three boxes are left intentionally blank and are not applicable to ERSRI.