Pension fund posts 8.03% return in Fiscal Year 2018 beating target and benchmarks

July 23, 2018: General Treasurer Seth Magaziner today announced that the State's pension fund finished its fiscal year ahead of its investment target and benchmarks.

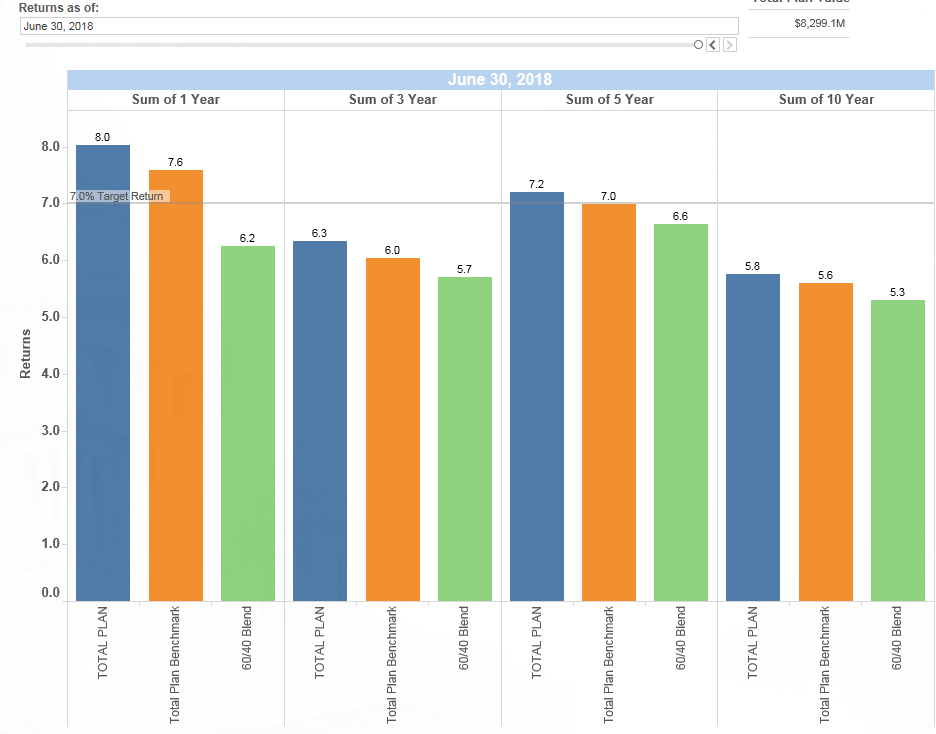

The fund returned 8.03 percent in the fiscal year ending June 30, 2018, ahead of its 7.0 percent annual target and ahead of its own benchmark which returned 7.59 percent over the same period. The fund also outperformed a traditional 60 percent stock/40 percent bonds portfolio which would have earned just 6.25 percent.

With this fiscal year's performance, the $8.3 billion fund continued its strong performance under Treasurer Magaziner's administration. Since taking office in January 2015, the fund earned more than $1.67 billion from its investments, $1.24 billion of which has been earned since Treasurer Magaziner's Back to Basics investment strategy was adopted in September 2016.

Part of the Back to Basics strategy included exiting most hedge funds in favor of more traditional strategies for growth and stability. Over the past 12 months, investments in private equity returned 17.9 and global index funds earned 11.5 percent net of fees and expenses.

"We have taken our investment strategy back to basics for our members, who count on us for a secure retirement, and for all taxpayers, who deserve responsible financial management from their elected officials," said Treasurer Magaziner.

All performance figures are net of fees and expenses. Investment information, including performance, fees and expenses, information about managers, and public records requests are available online at the Treasurer's Transparency Portal at: investments.treasury.ri.gov.