Pension Fund earns $55.4 million in April

May 23, 2018: Rhode Island's pension fund continued to deliver strong performance in April, earning $55.4 million. The fund's 0.67% return outperformed its own benchmark of 0.35 percent, as well as a traditional 60% stock/40% bonds strategy which would have returned 0.28 percent.

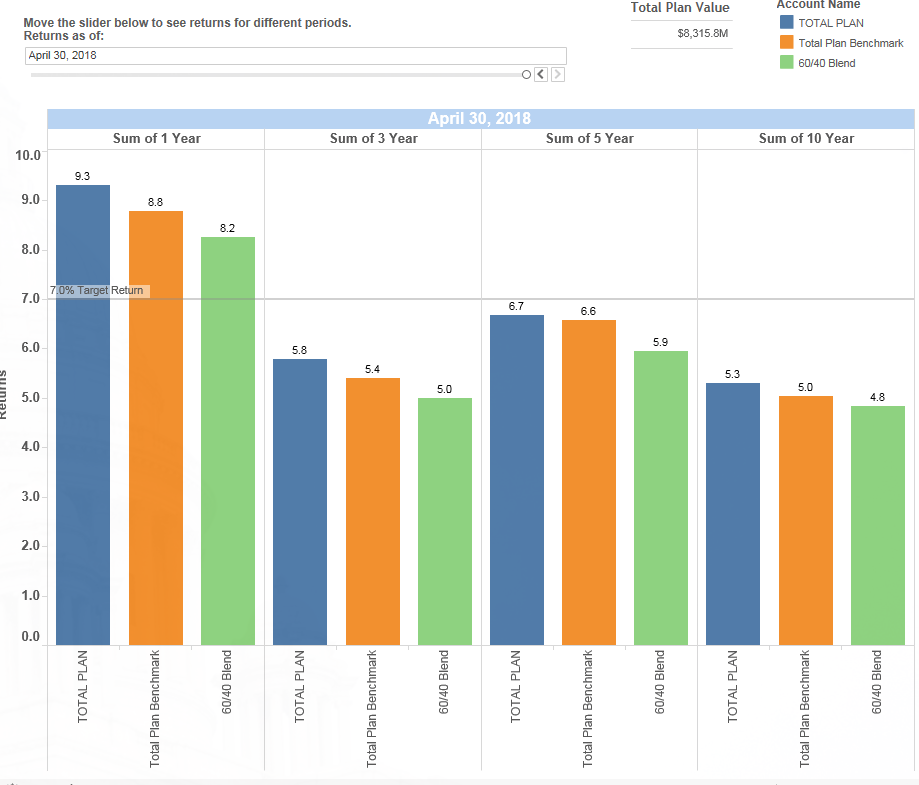

As of April 30, 2018, the fund has bested both benchmarks over one-year, three-year, and five-year timeframes. In the 12-month period preceding April 30, 2018, the fund returned 9.30 percent, beating its benchmark's 8.80 percent return, and the 8.25 percent return of a 60/40 portfolio. This performance was led by investments in international stock, which returned 16.36 percent and infrastructure which returned 15.14 percent for the fund.

Over a 3-year time frame, the fund's 5.79 percent annual return outperformed the 5.40 percent earnings of its benchmark and 4.99 percent from a 60/40 portfolio. Similarly, on a 5-year horizon, the fund's performance of 6.67 percent, beat out a 6.57 percent benchmark return while the 60/40 portfolio would have returned 5.95 percent annually over that same period.

Detailed information about the $8.3 billion fund, including the Back to Basics investment strategy, performance, and detailed information about its managers are published online as part of Treasurer Magaziner's 'Transparent Treasury' initiative at: investments.treasury.ri.gov.